In Part I, we started off on the road to “Integrated Business Planning” by posing 5 fundamental questions that need to be answered in evolving a strategic supply chain road-map (link here). Let’s take a look at the 1st question:

- To what extent has the supply chain ecology of my organization evolved? Answering this question enables assessment of the history and the AS IS snapshot of the maturity of an organization’s sales & operations planning capabilities.

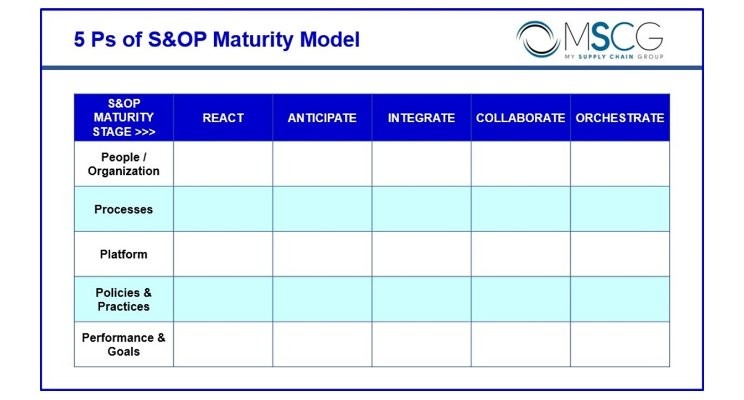

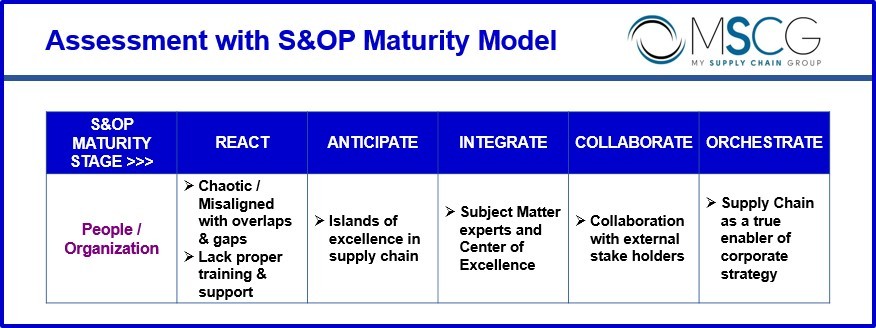

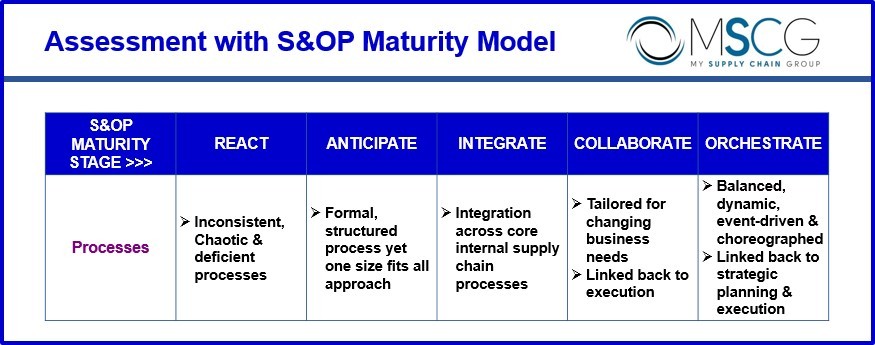

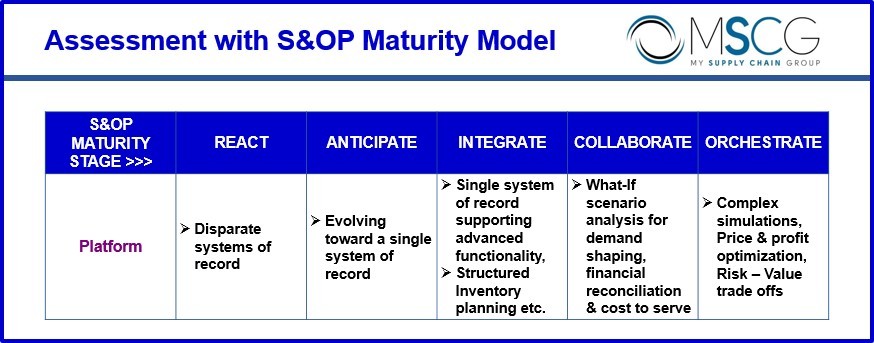

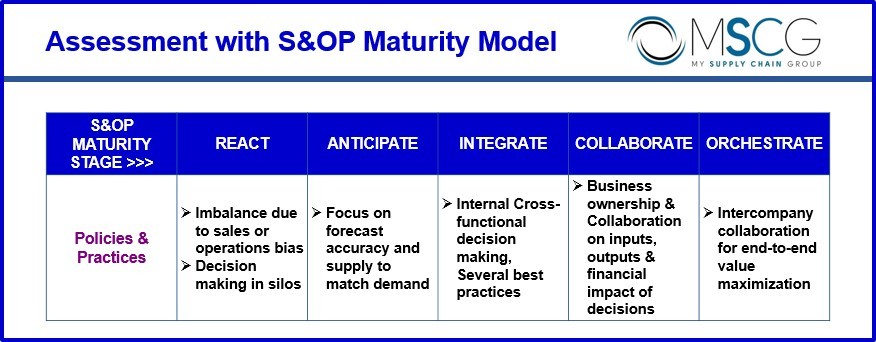

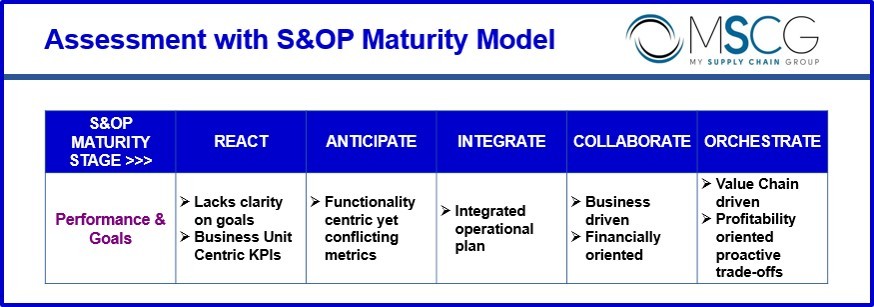

Gartner identifies 5 stages in the evolution of the maturity of sales & operations planning of an organization: React, Anticipate, Integrate, Collaborate & Orchestrate (link here). It is critical to assess and determine the current stage of maturity of 5 dimensions (5 Ps) of Sales & Operations Planning, namely, People, Processes, Platforms, Policies / Practices and Performance.

1. People, i.e., internal & external expertise available to an organization.

A client in the CPG industry held weekly training sessions for 15+ planners (driven by internal business and IT resources with our help) followed by exams with Multiple Choice Questions. They also pitted teams of planners against each other in the games of Jeopardy & Family Feud with questions focused on real life scenarios that the company encounters, supply chain basics and solution functionality. Each member of the winning teams received $25-$100 gift cards. Suffice to say, there was a dramatic improvement in the expertise level of the planners within 3-6 months.

2. Processes to successfully plan, execute and collaborate across S&OP functions on a repetitive basis.

Another client in the hi-tech industry was using advanced safety stock planing methods for its inventory planning process with a very elaborate sequence of steps for the determination of demand and supply variability and then the safety stock. However, there were several assumptions incorporated in the process that were wrong or no longer valid. The net result was that the planners simply did not believe the recommended safety stock quantities. Even worse, there was no well-defined and consistent process to help planners correct the safety stock quantities. This meant biases of individual planners based on their experience resulted in different approaches to “correcting” safety stock.

3. Platforms i.e. technology enablers facilitating all S&OP functions.

A client in the heavy machinery industry had very high levels of customization in its planning solution that had outlived its utility in the rapidly evolving business environment. This customization was actually coming in the way of the client using standard off-the-shelf functionality from its primary supply chain planing solution and dragging down overall maturity level of its S&OP functions.

4. Policies / Practices i.e., business rules & guidelines that direct how S&OP functions respond to situations & scenarios.

Another client, one of the largest industrial distributors, did not have policies in place that would have enabled planners to collaborate better with outside vendors. It could have negotiated better prices for its raw materials & trading goods in return for giving vendors visibility for its mid-term forecast and committing to buy a significant portion of it based on historical forecast accuracy.

5. Performance metrics – Goals & Key Performance Indicators (KPIs) to set targets and track outcomes that are critical to an organization.

KPIs of each business function can indeed be in conflict with each other. For example, higher customer service levels will need greater inventory & hence higher working capital. However, if there is no mechanism and accountability for balancing these conflicting trade-off, then excellence in the performance of an individual business function may not translate in to an overall advantage for the organization as a whole. Without balancing trade-offs, conflicting KPIs are simply working at cross-purpose with each other.

A couple of points to note:

In most organizations, the above 5 Ps are at different stages of S&OP maturity. Executives driving S&OP functions should focus on proactively pulling the laggard Ps up rather than letting the leading Ps slide down in maturity levels.

It is in the higher stages of maturity (Collaborate & Orchestrate) that S&OP is transformed in to Integrated Business Planning across business functions. It is here that collaboration with internal & external stake holders as well as consideration of service-level and profitability driven trade-offs results in value-maximization of S&OP functions. Only then can supply chain become a true enabler of corporate strategy and a real competitive advantage in the market.